“Bible-Based Responses

To

Your Financial Questions”

Here is a bit about what you can expect from this blog. Money is perhaps the least understood yet most discussed topic in our society today. Thousands of families daily make financial decisions based on bad advice.

In reality , the only totally reliable spiritual and financial advice comes from God’s Word–the Bible. I have found that the Bible addresses virtually every financial decision you or I will ever have to make. This Blog is dedicated to help you make those financial decisions–whether great or small. Here you will find many of the financial questions folks ask every day, along with Bible-based responses. These questions and responses are based on materials, publications, and my personal experiences gleaned from 33 years of prayerful service as a certified teacher, trainer, counselor, and/or coach representing the Dave Ramsey organization, the John Maxwell Team, Crown Ministries, and Christian Financial Concepts (Mr. Larry Burkett).

, the only totally reliable spiritual and financial advice comes from God’s Word–the Bible. I have found that the Bible addresses virtually every financial decision you or I will ever have to make. This Blog is dedicated to help you make those financial decisions–whether great or small. Here you will find many of the financial questions folks ask every day, along with Bible-based responses. These questions and responses are based on materials, publications, and my personal experiences gleaned from 33 years of prayerful service as a certified teacher, trainer, counselor, and/or coach representing the Dave Ramsey organization, the John Maxwell Team, Crown Ministries, and Christian Financial Concepts (Mr. Larry Burkett).

Our 501-c-3 non-profit ministry is Christian Financial Ministries (www.christianfinancialministries.org). We offer you the Holy Spirit inspired and led, Bible-based, Financial Freedom God’s Way Online Academy. Our motto is “Financial Freedom God’s Way: learn it, live it, and lead others to it.”

So, please scroll down, read, share with others, and be blessed in the Lord!

Bob Louder

NOTE: We will restart our BLOG in January 2023

Entries

May 31st, 2018 by Bob Louder

Bob: I was recently asked if I would consider offering credit repair services. Response: (Adapted from one of my heroes–Dave Ramsey): Absolutely not! Damaged credit can only be “restored”  over time in one of two ways: (1) clean up your debt by paying on it, or (2) ask to have inaccuracies removed. If you see something that isn’t accurate on your credit report, YOU can write a certified, return receipt requested letter to the credit bureau. Specify the inaccuracy on your report and that they have 30 days to correct it or take it off (they’ll take it off since they can’t correct it because you never did it). When you think that a credit repair company can straighten your “stuff” out and do credit repair, that’s when you tend to get ripped off. You cannot have bad credit taken off your credit report legally unless it’s inaccurate. Do not hire a credit restoration service company under any circumstances.

over time in one of two ways: (1) clean up your debt by paying on it, or (2) ask to have inaccuracies removed. If you see something that isn’t accurate on your credit report, YOU can write a certified, return receipt requested letter to the credit bureau. Specify the inaccuracy on your report and that they have 30 days to correct it or take it off (they’ll take it off since they can’t correct it because you never did it). When you think that a credit repair company can straighten your “stuff” out and do credit repair, that’s when you tend to get ripped off. You cannot have bad credit taken off your credit report legally unless it’s inaccurate. Do not hire a credit restoration service company under any circumstances.

Posted in Scam Alerts

May 31st, 2018 by Bob Louder

Question: “Should I continue to give while in debt.” Response: Great question. Here are several observations that will help shape an answer for you. (1) Proverbs 3:9-10 says we are to honor  God from the “first fruits.” Therefore, the first portion, the tithe, belongs to God, not to you and not to your creditors. (2) You have a clear responsibility before God to repay your debts. Psalm 37:21 states, “The wicked borrow and do not repay.” (3) You also have “other” responsibilities–responsibilities that don’t go away simply because you owe money to your creditors. For example, you have to keep paying for housing, utilities, food, and the many other practical needs of your family. (4) I believe that according to the Bible giving above and beyond the tithe is another important one of these “other” financial responsibilities. All things considered, then, it would be worth your while to explore ways to tithe, to pay your debts (at least cover the minimum payments required), to live (adjust your “needs, wants, and desires”) and to give above and beyond the tithe. How? Prayerfully work with the Holy Spirit, your spouse, and a financial coach (not a friend) to help you set up and stick to a spending plan (a “budget”) that provides for each.

God from the “first fruits.” Therefore, the first portion, the tithe, belongs to God, not to you and not to your creditors. (2) You have a clear responsibility before God to repay your debts. Psalm 37:21 states, “The wicked borrow and do not repay.” (3) You also have “other” responsibilities–responsibilities that don’t go away simply because you owe money to your creditors. For example, you have to keep paying for housing, utilities, food, and the many other practical needs of your family. (4) I believe that according to the Bible giving above and beyond the tithe is another important one of these “other” financial responsibilities. All things considered, then, it would be worth your while to explore ways to tithe, to pay your debts (at least cover the minimum payments required), to live (adjust your “needs, wants, and desires”) and to give above and beyond the tithe. How? Prayerfully work with the Holy Spirit, your spouse, and a financial coach (not a friend) to help you set up and stick to a spending plan (a “budget”) that provides for each.

Posted in Giving

April 23rd, 2018 by Bob Louder

Question: I teach a class on finances in my church, and one of my class members brought a question that I’m not sure how to answer. Can you tell me where in the Bible is says, “Neither a borrower nor a lender be”? I guess my main question is, “Should Christians borrow?” Response: First, the quote comes from Benjamin Franklin’s “Poor Richard’s Almanac.” It’s not from the  Bible; it’s what Larry Burkett used to call religious folklore. To answer your second question a-la Larry Burkett, (1) the Bible very clearly says that neither borrowing nor lending is prohibited, but there are some firm guidelines. (2) Borrowing is discouraged, and in fact, every biblical reference to it is a negative one. Consider Proverbs 22:7: “The rich rule over the poor, and the borrower is the servant to the lender.” (3) The scriptural guideline for borrowing is very clear. When you borrow money, it’s a promise to repay. Literally, borrowing is making a vow. God requires that we keep our vows. Psalm 37:21 says, “The wicked borrows and does not repay.” Therefore, if we don’t want to be counted among the evil, we are to repay everything we owe. If biblical times, when a man borrowed money and couldn’t repay, he was thrown into prison, and his family was sold into slavery. When somebody gave his word and then didn’t keep it, that person greatly dishonored himself. It was worse than stealing, because a trust was violated. Just because we don’t throw people into prison today doesn’t make the trust relationship any different. Scripture shows us that we’re to be cautious about borrowing, and it should never be normal. Yet, when you look at our society today, you find that borrowing is rampant. We think it’s normal to borrow for periods of thirty to forty years or more. We have created personal and national economies that must borrow to exist. That’s not God’s way. God says in the book of Deuteronomy that borrowing is a consequence of ignoring His statutes and commandments (28:43-45).

Bible; it’s what Larry Burkett used to call religious folklore. To answer your second question a-la Larry Burkett, (1) the Bible very clearly says that neither borrowing nor lending is prohibited, but there are some firm guidelines. (2) Borrowing is discouraged, and in fact, every biblical reference to it is a negative one. Consider Proverbs 22:7: “The rich rule over the poor, and the borrower is the servant to the lender.” (3) The scriptural guideline for borrowing is very clear. When you borrow money, it’s a promise to repay. Literally, borrowing is making a vow. God requires that we keep our vows. Psalm 37:21 says, “The wicked borrows and does not repay.” Therefore, if we don’t want to be counted among the evil, we are to repay everything we owe. If biblical times, when a man borrowed money and couldn’t repay, he was thrown into prison, and his family was sold into slavery. When somebody gave his word and then didn’t keep it, that person greatly dishonored himself. It was worse than stealing, because a trust was violated. Just because we don’t throw people into prison today doesn’t make the trust relationship any different. Scripture shows us that we’re to be cautious about borrowing, and it should never be normal. Yet, when you look at our society today, you find that borrowing is rampant. We think it’s normal to borrow for periods of thirty to forty years or more. We have created personal and national economies that must borrow to exist. That’s not God’s way. God says in the book of Deuteronomy that borrowing is a consequence of ignoring His statutes and commandments (28:43-45).

Posted in Borrowing & Debt

April 23rd, 2018 by Bob Louder

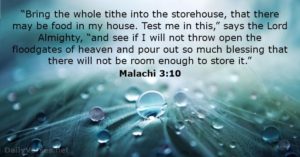

Question: Bob, in your opinion will I be denying God if I don’t give to the Lord’s Work? I’m married to a really good man who is not a Christian. I’d like to be able to give to the Lord’s work, but  he does’t want me to. In fact, our only arguments are about giving. And, if I decide to give, should it come from my income only and not from his? Response: God’s Word says, “Wives, be subject to your husbands, as is fitting in the Lord” (Colossians 3:18). If your husband is not a believer and doesn’t want to give, in my opinion, you should not give. HOWEVER, I encourage you to “test” this opinion by (1) sharing Malachi 3:10 with him: “Bring the whole tithe into the storehouse, so that there may be food in My house, and test Me now in this…if I will not open for you the windows of heaven and pour out for you a blessing until it overflows.” (2) Then ask him if you can tithe a small amount of money on a regular basis for one year with the condition that you will stop if your not better off financially at the end of that year. (According to the Bible, tithing in one area that we can “test” and trust Him and when we do He promises to prove Himself trustworthy.) (3) I strongly suggest that you do not categorize your incomes as “mine” and “his.” When you begin to split incomes, you begin to split families. Instead, make the commitment that it is all “our income.” It is all from the Lord and not from you or your husband, so you should treat it that way (Deuteronomy 8:17-18)

he does’t want me to. In fact, our only arguments are about giving. And, if I decide to give, should it come from my income only and not from his? Response: God’s Word says, “Wives, be subject to your husbands, as is fitting in the Lord” (Colossians 3:18). If your husband is not a believer and doesn’t want to give, in my opinion, you should not give. HOWEVER, I encourage you to “test” this opinion by (1) sharing Malachi 3:10 with him: “Bring the whole tithe into the storehouse, so that there may be food in My house, and test Me now in this…if I will not open for you the windows of heaven and pour out for you a blessing until it overflows.” (2) Then ask him if you can tithe a small amount of money on a regular basis for one year with the condition that you will stop if your not better off financially at the end of that year. (According to the Bible, tithing in one area that we can “test” and trust Him and when we do He promises to prove Himself trustworthy.) (3) I strongly suggest that you do not categorize your incomes as “mine” and “his.” When you begin to split incomes, you begin to split families. Instead, make the commitment that it is all “our income.” It is all from the Lord and not from you or your husband, so you should treat it that way (Deuteronomy 8:17-18)

Posted in Husbands and Wives

April 6th, 2018 by Bob Louder

Question: Rev Louder, I’m a Christian and I know I can ask God to meet my spiritual needs–is it OK for me to ask him to meet my financial needs? Response: According to the Bible, YES you can ask God to meet your financial needs. How? James 1:6 tells you to “ask”, believe and not doubt. The key to this verse and the answer to your question is the word “ask”. This is a Greek word that means to be absolutely firm; to respectfully and  expectantly speak up, speak out, praying boldly and authoritatively for the help you need to meet your physical/material needs such as food, shelter, money, etc. (Note we’re talking about “needs” here as opposed to your “wants” or “desires” which are topics for a different time.) So yes, your Heavenly Father wants you to ask Him to meet your financial/material needs–if you have a physical, tangible need, He wants you to ask Him to meet it. And remember, it may take time for your answer to show up. Just because you “ask” in faith according to His will doesn’t mean your answer is always right around the corner. Beware: (1) There is a devil out there who doesn’t want you to experience God’s will for your life to include His material/financial will for your life; (2) You also have your own flesh to deal with, and flesh loves comfort–it doesn’t like the challenge of “asking”/standing in faith; and (3) Your faith may need to grow. So what should you do until your answer shows up? Keep asking. Don’t back off. Refuse to move from your position of faith. Stand on the fact that the Word of God is true. God wants you to come to a higher level in the process of receiving the answer to your prayer. The bottom line is this: Never make the mistake of thinking you can only talk to God about your spiritual needs. YES you can ask God to meet your financial needs.

expectantly speak up, speak out, praying boldly and authoritatively for the help you need to meet your physical/material needs such as food, shelter, money, etc. (Note we’re talking about “needs” here as opposed to your “wants” or “desires” which are topics for a different time.) So yes, your Heavenly Father wants you to ask Him to meet your financial/material needs–if you have a physical, tangible need, He wants you to ask Him to meet it. And remember, it may take time for your answer to show up. Just because you “ask” in faith according to His will doesn’t mean your answer is always right around the corner. Beware: (1) There is a devil out there who doesn’t want you to experience God’s will for your life to include His material/financial will for your life; (2) You also have your own flesh to deal with, and flesh loves comfort–it doesn’t like the challenge of “asking”/standing in faith; and (3) Your faith may need to grow. So what should you do until your answer shows up? Keep asking. Don’t back off. Refuse to move from your position of faith. Stand on the fact that the Word of God is true. God wants you to come to a higher level in the process of receiving the answer to your prayer. The bottom line is this: Never make the mistake of thinking you can only talk to God about your spiritual needs. YES you can ask God to meet your financial needs.

Posted in Faith

April 3rd, 2018 by Bob Louder

Question: Bob, our church teaches that the entire tithe should go to the local church. What does the Bible say? Response: In the book of Old Testament book of Malachi we’re told that God wants us to direct our entire tithe into the storehouse. So I believe it’s necessary that we compare the Old Testament storehouse to the New Testament church. The Old Testament storehouse had four functions: (1) Feed the  tribe of Levi and the priests of Aaron. This would seem to be equivalent to our pastors and church staff members today. (2) Feed the prophets. A prophet in the Old Testament was not necessarily somebody who could “forthtell” the future but someone who could “forthtell” the truth. Today this would point to our missionaries and evangelists. (3) Feed the Hebrew widows and orphans living within the city. Today this would be roughly equivalent to the widows, orphans, and invalids in our local churches. (4) In addition a special tithe was taken every third year to feed the widows and orphans of the Gentiles living in and around the Hebrew city. This would seem to equate to the unsaved folks surrounding our local churches. Here’s the point: Many churches serve the fourfold function of the OT storehouse, and others do not. Does yours? Do you know? If you don’t know, I suggest you prayerfully and humbly ask. Your decision must be based on your church’s obedience to God’s Word. If a local church doesn’t accept the responsibility of being the storehouse, then believers must help ensure that the fourfold function is accomplished through other means.

tribe of Levi and the priests of Aaron. This would seem to be equivalent to our pastors and church staff members today. (2) Feed the prophets. A prophet in the Old Testament was not necessarily somebody who could “forthtell” the future but someone who could “forthtell” the truth. Today this would point to our missionaries and evangelists. (3) Feed the Hebrew widows and orphans living within the city. Today this would be roughly equivalent to the widows, orphans, and invalids in our local churches. (4) In addition a special tithe was taken every third year to feed the widows and orphans of the Gentiles living in and around the Hebrew city. This would seem to equate to the unsaved folks surrounding our local churches. Here’s the point: Many churches serve the fourfold function of the OT storehouse, and others do not. Does yours? Do you know? If you don’t know, I suggest you prayerfully and humbly ask. Your decision must be based on your church’s obedience to God’s Word. If a local church doesn’t accept the responsibility of being the storehouse, then believers must help ensure that the fourfold function is accomplished through other means.

Posted in Giving

March 12th, 2018 by Bob Louder

Question: We are almost out of debt again. I say “again” because this is the fourth time that we’ve worked our way totally out of debt and then gotten back into it again. It seems like once the  pressure is off we go back to spending. Response: Here are a couple points to consider. First, becoming and staying debt free is a spiritual issue that requires spiritual decisions. There are over 3000 verses in the Bible having to do with money and material possessions which can be summarized in the biblical principles of “Wealth” (He’s the owner–all wealth comes from Him) and “Stewardship” (your job is to manage what He gives you). I suggest you prayerfully consider working through our Financial Freedom God’s Way Online Academy to better understand both the spiritual nature of your financial attitudes and actions AND learn how to get God’s financial Words up and operating in your life. The second point to consider is that getting and staying debt free requires personal discipline. For example, use an Impulse Buying Sheet to help you prayerfully control non-budget spending. For anything you want to buy that isn’t already in your budget and costs more than $10, you get three additional prices and wait thirty days before you buy it (or whatever period of time that feels comfortable to you). This will give you time to shop for a better price, and often it allows enough time for that impulse to pass. As soon as the impulse passes, you probably won’t even buy that item. What’s happening in your situation, I expect, is that you’ve gotten yourself into the habit of living beyond your means by spending more than you make. So, you go on a crash budget for a while then start overspending again partially because you’re tired of the crash budget. Crash budgets, like crash diets, seldom work. The only way to break this cycle is to be disciplined, over time, to learn, apply and pass along what God’s Word has to say about how to manage HIS wealth.

pressure is off we go back to spending. Response: Here are a couple points to consider. First, becoming and staying debt free is a spiritual issue that requires spiritual decisions. There are over 3000 verses in the Bible having to do with money and material possessions which can be summarized in the biblical principles of “Wealth” (He’s the owner–all wealth comes from Him) and “Stewardship” (your job is to manage what He gives you). I suggest you prayerfully consider working through our Financial Freedom God’s Way Online Academy to better understand both the spiritual nature of your financial attitudes and actions AND learn how to get God’s financial Words up and operating in your life. The second point to consider is that getting and staying debt free requires personal discipline. For example, use an Impulse Buying Sheet to help you prayerfully control non-budget spending. For anything you want to buy that isn’t already in your budget and costs more than $10, you get three additional prices and wait thirty days before you buy it (or whatever period of time that feels comfortable to you). This will give you time to shop for a better price, and often it allows enough time for that impulse to pass. As soon as the impulse passes, you probably won’t even buy that item. What’s happening in your situation, I expect, is that you’ve gotten yourself into the habit of living beyond your means by spending more than you make. So, you go on a crash budget for a while then start overspending again partially because you’re tired of the crash budget. Crash budgets, like crash diets, seldom work. The only way to break this cycle is to be disciplined, over time, to learn, apply and pass along what God’s Word has to say about how to manage HIS wealth.

Posted in Staying Debt Free

February 22nd, 2018 by Bob Louder

Question:

Question: I am 60 years old. My husband of 31 years died at age 64. I have not remarried. Can I collect on his Social Security at a reduced rate without jeopardizing any of my own Social Security?

Response: First let me say I am saddened by your loss. The short answer to your question is “yes” you can draw a survivor benefit without impacting your own retirement benefit. You can start your widow benefit at age 60 and then collect your own, unreduced, social security at age 66 or 70. HOWEVER, before you make any Social Security election you need to thoroughly understand your options. I recommend you talk directly to a Social Security professional at your local Social Security office. Or, you can call the Social Security Administration toll-free at 1-800-772-1213 and use their automated telephone services to get recorded information and conduct some business 24 hours a day. (

www.christianfinancialministries.org)

Posted in Retirement

February 2nd, 2018 by Bob Louder

Question: My wife and I have made a commitment to get out of debt, but we owe a lot–on credit cards and to small loan companies–and all of them come with high interest rates. Is it logical for us to consolidate those loans into one unsecured loan with a smaller interest rate? Should we consider a home equity loan? Response: Praise the Lord that He is leading you and your wife to get out of debt! And YES, it  does make sense to consolidate your debts at a lower interest rate–but NOT RIGHT NOW! Here’s a sequence I suggest you prayerfully consider: (1) Develop a budget to help you make better spending decisions. (2) Commit to living on your budget for six months. (3) Work to wean yourselves from using debt to live. Consider consolidation loans only after you can live without credit so that you solve your true problems rather than simply treat the symptoms (your symptoms may be financial but your problems are always spiritual). A home equity loan may be the best interest rate you can get (shop around and check out the on-line/local Better Business Bureaus). It’s the most logical choice because you are using the equity to substitute for higher interest loans. But be certain that the loan has a fixed interest rate and not a variable or floating rate. However, you need to pray about all of this with your wife to be sure that you both agree on everything. With rare exception, most women don’t want to borrow on the equity in their homes. to them, a home represents security and comfort, not a source of money.

does make sense to consolidate your debts at a lower interest rate–but NOT RIGHT NOW! Here’s a sequence I suggest you prayerfully consider: (1) Develop a budget to help you make better spending decisions. (2) Commit to living on your budget for six months. (3) Work to wean yourselves from using debt to live. Consider consolidation loans only after you can live without credit so that you solve your true problems rather than simply treat the symptoms (your symptoms may be financial but your problems are always spiritual). A home equity loan may be the best interest rate you can get (shop around and check out the on-line/local Better Business Bureaus). It’s the most logical choice because you are using the equity to substitute for higher interest loans. But be certain that the loan has a fixed interest rate and not a variable or floating rate. However, you need to pray about all of this with your wife to be sure that you both agree on everything. With rare exception, most women don’t want to borrow on the equity in their homes. to them, a home represents security and comfort, not a source of money.

Posted in Borrowing & Debt

January 12th, 2018 by Bob Louder

Question: Should a child have an allowance? Response: Proverbs 3:12 says, “…because the LORD disciplines those He loves, as a father the son he delights in.” Don’t teach your children to expect allowances, rather teach them to work and earn money. The term “allowance” implies something is given rather than earned. If God doesn’t provide us with an allowance, and he doesn’t, then we probably should not provide allowances to our children. If you have a child who demonstrates discipline in handling money and you want to hive him or her a gift from time to time, that’s great. Just be certain that you’re establishing long-term values in your children that will guide them when they are adults. The Lord showed my wife and me that we were to make chores a normal part of our family life. We started when our children were 3-4 years old and included fun activities that they were eager to do–help cook for our daughter, help me wash the car and power wash the house for our son, etc. Many times our children displayed great attitudes by “going above and beyond” the chore list–sometimes their reward was a thank you hug as we let them know how important they are and how much they mean to our family. Other times we added a bit of cash to their pocket. You can find a whole world of “helps” in this area on Google.

Question: Should a child have an allowance? Response: Proverbs 3:12 says, “…because the LORD disciplines those He loves, as a father the son he delights in.” Don’t teach your children to expect allowances, rather teach them to work and earn money. The term “allowance” implies something is given rather than earned. If God doesn’t provide us with an allowance, and he doesn’t, then we probably should not provide allowances to our children. If you have a child who demonstrates discipline in handling money and you want to hive him or her a gift from time to time, that’s great. Just be certain that you’re establishing long-term values in your children that will guide them when they are adults. The Lord showed my wife and me that we were to make chores a normal part of our family life. We started when our children were 3-4 years old and included fun activities that they were eager to do–help cook for our daughter, help me wash the car and power wash the house for our son, etc. Many times our children displayed great attitudes by “going above and beyond” the chore list–sometimes their reward was a thank you hug as we let them know how important they are and how much they mean to our family. Other times we added a bit of cash to their pocket. You can find a whole world of “helps” in this area on Google.

Posted in Children and Money

over time in one of two ways: (1) clean up your debt by paying on it, or (2) ask to have inaccuracies removed. If you see something that isn’t accurate on your credit report, YOU can write a certified, return receipt requested letter to the credit bureau. Specify the inaccuracy on your report and that they have 30 days to correct it or take it off (they’ll take it off since they can’t correct it because you never did it). When you think that a credit repair company can straighten your “stuff” out and do credit repair, that’s when you tend to get ripped off. You cannot have bad credit taken off your credit report legally unless it’s inaccurate. Do not hire a credit restoration service company under any circumstances.

over time in one of two ways: (1) clean up your debt by paying on it, or (2) ask to have inaccuracies removed. If you see something that isn’t accurate on your credit report, YOU can write a certified, return receipt requested letter to the credit bureau. Specify the inaccuracy on your report and that they have 30 days to correct it or take it off (they’ll take it off since they can’t correct it because you never did it). When you think that a credit repair company can straighten your “stuff” out and do credit repair, that’s when you tend to get ripped off. You cannot have bad credit taken off your credit report legally unless it’s inaccurate. Do not hire a credit restoration service company under any circumstances.

, the only totally reliable spiritual and financial advice comes from God’s Word–the Bible. I have found that the Bible addresses virtually every financial decision you or I will ever have to make. This Blog is dedicated to help you make those financial decisions–whether great or small. Here you will find many of the financial questions folks ask every day, along with Bible-based responses. These questions and responses are based on materials, publications, and my personal experiences gleaned from 33 years of prayerful service as a certified teacher, trainer, counselor, and/or coach representing the Dave Ramsey organization, the John Maxwell Team, Crown Ministries, and Christian Financial Concepts (Mr. Larry Burkett).

, the only totally reliable spiritual and financial advice comes from God’s Word–the Bible. I have found that the Bible addresses virtually every financial decision you or I will ever have to make. This Blog is dedicated to help you make those financial decisions–whether great or small. Here you will find many of the financial questions folks ask every day, along with Bible-based responses. These questions and responses are based on materials, publications, and my personal experiences gleaned from 33 years of prayerful service as a certified teacher, trainer, counselor, and/or coach representing the Dave Ramsey organization, the John Maxwell Team, Crown Ministries, and Christian Financial Concepts (Mr. Larry Burkett).

God from the “first fruits.” Therefore, the first portion, the tithe, belongs to God, not to you and not to your creditors. (2) You have a clear responsibility before God to repay your debts. Psalm 37:21 states, “The wicked borrow and do not repay.” (3) You also have “other” responsibilities–responsibilities that don’t go away simply because you owe money to your creditors. For example, you have to keep paying for housing, utilities, food, and the many other practical needs of your family. (4) I believe that according to the Bible giving above and beyond the tithe is another important one of these “other” financial responsibilities. All things considered, then, it would be worth your while to explore ways to tithe, to pay your debts (at least cover the minimum payments required), to live (adjust your “needs, wants, and desires”) and to give above and beyond the tithe. How? Prayerfully work with the Holy Spirit, your spouse, and a financial coach (not a friend) to help you set up and stick to a spending plan (a “budget”) that provides for each.

God from the “first fruits.” Therefore, the first portion, the tithe, belongs to God, not to you and not to your creditors. (2) You have a clear responsibility before God to repay your debts. Psalm 37:21 states, “The wicked borrow and do not repay.” (3) You also have “other” responsibilities–responsibilities that don’t go away simply because you owe money to your creditors. For example, you have to keep paying for housing, utilities, food, and the many other practical needs of your family. (4) I believe that according to the Bible giving above and beyond the tithe is another important one of these “other” financial responsibilities. All things considered, then, it would be worth your while to explore ways to tithe, to pay your debts (at least cover the minimum payments required), to live (adjust your “needs, wants, and desires”) and to give above and beyond the tithe. How? Prayerfully work with the Holy Spirit, your spouse, and a financial coach (not a friend) to help you set up and stick to a spending plan (a “budget”) that provides for each. Bible; it’s what Larry Burkett used to call religious folklore. To answer your second question a-la Larry Burkett, (1) the Bible very clearly says that neither borrowing nor lending is prohibited, but there are some firm guidelines. (2) Borrowing is discouraged, and in fact, every biblical reference to it is a negative one. Consider Proverbs 22:7: “The rich rule over the poor, and the borrower is the servant to the lender.” (3) The scriptural guideline for borrowing is very clear. When you borrow money, it’s a promise to repay. Literally, borrowing is making a vow. God requires that we keep our vows. Psalm 37:21 says, “The wicked borrows and does not repay.” Therefore, if we don’t want to be counted among the evil, we are to repay everything we owe. If biblical times, when a man borrowed money and couldn’t repay, he was thrown into prison, and his family was sold into slavery. When somebody gave his word and then didn’t keep it, that person greatly dishonored himself. It was worse than stealing, because a trust was violated. Just because we don’t throw people into prison today doesn’t make the trust relationship any different. Scripture shows us that we’re to be cautious about borrowing, and it should never be normal. Yet, when you look at our society today, you find that borrowing is rampant. We think it’s normal to borrow for periods of thirty to forty years or more. We have created personal and national economies that must borrow to exist. That’s not God’s way. God says in the book of Deuteronomy that borrowing is a consequence of ignoring His statutes and commandments (28:43-45).

Bible; it’s what Larry Burkett used to call religious folklore. To answer your second question a-la Larry Burkett, (1) the Bible very clearly says that neither borrowing nor lending is prohibited, but there are some firm guidelines. (2) Borrowing is discouraged, and in fact, every biblical reference to it is a negative one. Consider Proverbs 22:7: “The rich rule over the poor, and the borrower is the servant to the lender.” (3) The scriptural guideline for borrowing is very clear. When you borrow money, it’s a promise to repay. Literally, borrowing is making a vow. God requires that we keep our vows. Psalm 37:21 says, “The wicked borrows and does not repay.” Therefore, if we don’t want to be counted among the evil, we are to repay everything we owe. If biblical times, when a man borrowed money and couldn’t repay, he was thrown into prison, and his family was sold into slavery. When somebody gave his word and then didn’t keep it, that person greatly dishonored himself. It was worse than stealing, because a trust was violated. Just because we don’t throw people into prison today doesn’t make the trust relationship any different. Scripture shows us that we’re to be cautious about borrowing, and it should never be normal. Yet, when you look at our society today, you find that borrowing is rampant. We think it’s normal to borrow for periods of thirty to forty years or more. We have created personal and national economies that must borrow to exist. That’s not God’s way. God says in the book of Deuteronomy that borrowing is a consequence of ignoring His statutes and commandments (28:43-45). he does’t want me to. In fact, our only arguments are about giving. And, if I decide to give, should it come from my income only and not from his?

he does’t want me to. In fact, our only arguments are about giving. And, if I decide to give, should it come from my income only and not from his?  expectantly speak up, speak out, praying boldly and authoritatively for the help you need to meet your physical/material needs such as food, shelter, money, etc. (Note we’re talking about “needs” here as opposed to your “wants” or “desires” which are topics for a different time.) So yes, your Heavenly Father wants you to ask Him to meet your financial/material needs–if you have a physical, tangible need, He wants you to ask Him to meet it. And remember, it may take time for your answer to show up. Just because you “ask” in faith according to His will doesn’t mean your answer is always right around the corner. Beware: (1) There is a devil out there who doesn’t want you to experience God’s will for your life to include His material/financial will for your life; (2) You also have your own flesh to deal with, and flesh loves comfort–it doesn’t like the challenge of “asking”/standing in faith; and (3) Your faith may need to grow. So what should you do until your answer shows up? Keep asking. Don’t back off. Refuse to move from your position of faith. Stand on the fact that the Word of God is true. God wants you to come to a higher level in the process of receiving the answer to your prayer. The bottom line is this: Never make the mistake of thinking you can only talk to God about your spiritual needs. YES you can ask God to meet your financial needs.

expectantly speak up, speak out, praying boldly and authoritatively for the help you need to meet your physical/material needs such as food, shelter, money, etc. (Note we’re talking about “needs” here as opposed to your “wants” or “desires” which are topics for a different time.) So yes, your Heavenly Father wants you to ask Him to meet your financial/material needs–if you have a physical, tangible need, He wants you to ask Him to meet it. And remember, it may take time for your answer to show up. Just because you “ask” in faith according to His will doesn’t mean your answer is always right around the corner. Beware: (1) There is a devil out there who doesn’t want you to experience God’s will for your life to include His material/financial will for your life; (2) You also have your own flesh to deal with, and flesh loves comfort–it doesn’t like the challenge of “asking”/standing in faith; and (3) Your faith may need to grow. So what should you do until your answer shows up? Keep asking. Don’t back off. Refuse to move from your position of faith. Stand on the fact that the Word of God is true. God wants you to come to a higher level in the process of receiving the answer to your prayer. The bottom line is this: Never make the mistake of thinking you can only talk to God about your spiritual needs. YES you can ask God to meet your financial needs. tribe of Levi and the priests of Aaron. This would seem to be equivalent to our pastors and church staff members today. (2) Feed the prophets. A prophet in the Old Testament was not necessarily somebody who could “forthtell” the future but someone who could “forthtell” the truth. Today this would point to our missionaries and evangelists. (3) Feed the Hebrew widows and orphans living within the city. Today this would be roughly equivalent to the widows, orphans, and invalids in our local churches. (4) In addition a special tithe was taken every third year to feed the widows and orphans of the Gentiles living in and around the Hebrew city. This would seem to equate to the unsaved folks surrounding our local churches. Here’s the point: Many churches serve the fourfold function of the OT storehouse, and others do not. Does yours? Do you know? If you don’t know, I suggest you prayerfully and humbly ask. Your decision must be based on your church’s obedience to God’s Word. If a local church doesn’t accept the responsibility of being the storehouse, then believers must help ensure that the fourfold function is accomplished through other means.

tribe of Levi and the priests of Aaron. This would seem to be equivalent to our pastors and church staff members today. (2) Feed the prophets. A prophet in the Old Testament was not necessarily somebody who could “forthtell” the future but someone who could “forthtell” the truth. Today this would point to our missionaries and evangelists. (3) Feed the Hebrew widows and orphans living within the city. Today this would be roughly equivalent to the widows, orphans, and invalids in our local churches. (4) In addition a special tithe was taken every third year to feed the widows and orphans of the Gentiles living in and around the Hebrew city. This would seem to equate to the unsaved folks surrounding our local churches. Here’s the point: Many churches serve the fourfold function of the OT storehouse, and others do not. Does yours? Do you know? If you don’t know, I suggest you prayerfully and humbly ask. Your decision must be based on your church’s obedience to God’s Word. If a local church doesn’t accept the responsibility of being the storehouse, then believers must help ensure that the fourfold function is accomplished through other means. pressure is off we go back to spending.

pressure is off we go back to spending.  does make sense to consolidate your debts at a lower interest rate–but NOT RIGHT NOW! Here’s a sequence I suggest you prayerfully consider: (1) Develop a budget to help you make better spending decisions. (2) Commit to living on your budget for six months. (3) Work to wean yourselves from using debt to live. Consider consolidation loans only after you can live without credit so that you solve your true problems rather than simply treat the symptoms (your symptoms may be financial but your problems are always spiritual). A home equity loan may be the best interest rate you can get (shop around and check out the on-line/local Better Business Bureaus). It’s the most logical choice because you are using the equity to substitute for higher interest loans. But be certain that the loan has a fixed interest rate and not a variable or floating rate. However, you need to pray about all of this with your wife to be sure that you both agree on everything. With rare exception, most women don’t want to borrow on the equity in their homes. to them, a home represents security and comfort, not a source of money.

does make sense to consolidate your debts at a lower interest rate–but NOT RIGHT NOW! Here’s a sequence I suggest you prayerfully consider: (1) Develop a budget to help you make better spending decisions. (2) Commit to living on your budget for six months. (3) Work to wean yourselves from using debt to live. Consider consolidation loans only after you can live without credit so that you solve your true problems rather than simply treat the symptoms (your symptoms may be financial but your problems are always spiritual). A home equity loan may be the best interest rate you can get (shop around and check out the on-line/local Better Business Bureaus). It’s the most logical choice because you are using the equity to substitute for higher interest loans. But be certain that the loan has a fixed interest rate and not a variable or floating rate. However, you need to pray about all of this with your wife to be sure that you both agree on everything. With rare exception, most women don’t want to borrow on the equity in their homes. to them, a home represents security and comfort, not a source of money. Question:

Question: